Bitcoins and Gravy #57 Alpha Point: Powerful Software! (Transcript)

Episode notes and comments page :

https://letstalkbitcoin.com/blog/post/bitcoins-and-gravy-57-alpha-point-powerful-software-3

Professional transcription provided by a fan and consultant of the show, who can be found at http://www.diaryofafreelancetranscriptionist.com

[0:00] John Barrett (Announcer and Host): Welcome to Bitcoins and Gravy, episode #57. At the time of this recording, Bitcoins are trading at $251.00 [US] dollars each, and everybody’s favorite, LTBCoins, are trading at $0.000248 U.S. dollars. Mmm…Mmm…Mmm… Now THAT’S gravy!

[show intro music]

[0:24] John : Welcome to "Bitcoins and Gravy", and thanks for joining me as I podcast from East Nashville, Tennessee, with my trusty Siberian Husky by my side. Say hello Maxwell.

Max : Grrrrr…..

[0:36] John : We’re two Bitcoin enthusiasts who love talking about Bitcoins, and sharing what we learn with you the listener. Long time listeners, thanks for being here with us again, [and] new listeners, I hope you enjoy the show. Disclaimer John : And I do have to tell everyone that there WILL be some profanity in this show – in the second half – so no worries about the first half. But if you, or your children, do not want to hear profanity, you may wish to turn the show off right after the interview, when the profanity will begin. A few things have upset me recently, and I find it very difficult to voice those things without using profanity. Maybe that’s a deficit on my part, but that is what it is. So please keep that in mind moving forward.

[1:16] John : On today's show I speak with Vadim Telyatnikov ( http://www.linkedin.com/in/vadimtelyatnikov/en ), the CEO of Alpha Point (https://alphapoint.com/ ). Alpha Point is powerful software that allows you to launch an exchange in days, not months. Alpha Point supports multiple languages, interfaces and protocols. It also supports any and all fiat and crypto-currencies. Throughout the interview we talk about Hedge funds and exchanges, how Alpha Point is different from its competitors, and of course about the future of everyone’s favorite currency - Bitcoin!

[Segway music]

[1:53] John : All right, listeners. Today I am pleased to welcome to the show the CEO of Alpha Point, Vadim Telyatnikov. Vadim, welcome to Bitcoins and Gravy.

Vadim : Thanks John I’m very happy to be here.

John : Yes sir. And tell me, you’re in New York, is that right?

Vadim : Yeah, that’s correct. We’re headquartered in New York.

John : All right. Well, you know, we’re getting a lot of snow and ice here in Nashville. What’s your weather like there?

Vadim : Freezing. I think yesterday, or two days ago, the wind chill was negative 17 degree. So [we’re] bundling up with lots of layers.

[2:24] John : [laughter] That’s right. Just like Mom taught us, right? Lots of layers.

Vadim : That’s right. Well, I was born in Moscow, Russia. So I got used to the cold. But, believe it or not, I never was cold until we moved to the US, [when] I was nine, just because we knew how to dress when it was ALWAYS cold. And you, kind of, lose that when it’s sometimes warm.

[2:45] John : Wow. That’s neat [that] you were born in Moscow. I actually have a nephew who was born in Russia. My sister and her husband adopted him, and he’s now just fully American, and he talks just exactly like you – except his voice is not as deep, because he’s only 10 years old.

Vadim : That’s great.

John : Well let’s see here. Now today we are going to talk about Alpha Point. First of all, if you can explain for the listeners : What is Alpha Point?

Vadim : Sure, [I’m] happy to. We offer a white label platform that powers digital currency exchanges. We have 18 exchange clients that we power in 15 different countries. Some examples are meXBT (https://mexbt.com/en/ ) , that’s focused on Latin America; Bit – that’s soon launching in the Caribbean; and the largest being BitFinex (https://www.bitfinex.com/ ), which is one of the largest exchanges in the world.

John : Wow.

[3:30] Vadim : So, in the aggregate, very soon we’ll be processing over $300 million worth of trades between digital currency – primarily Bitcoin – and the US dollar.

John : So what is your biggest achievement to date?

Vadim : So I think signing up BitFinex as a partner. That’s leveraging the platform – certainly one of them. We’re super-excited about working together with them, and basically helping enable them for high-frequency trading. I think both of our views is that institutional players on Wall Street are going to get into digital currency in a big way – probably soon. And they want to upgrade their platform to prepare for that. So we’re certainly happy about that. We also recently raised a little bit under $1.5 million in funding, so I think that’s another milestone that we’re very excited about.

[4:17] John : Wow! That’s great. Now when you say “we”, you’re working with your brother Igor, is that right?

Vadim : My brother Igor, that’s right. We also have great guys on the tech side that actually founded the company. Joe Ventura ( http://www.linkedin.com/in/joeven/en ), who’s the CTO and founder. His background is building high-frequency trading applications and risk management systems for big banks – Deutsche bank being an example. Then the other technical cofounder is Jack Salen. He has over 15 years of experience on the trading side, building trading platforms, trading systems, and arbitrage strategies – primarily on the commodities side, working with exchanges such as the CME.

[5:00] John : Okay, now Vadim, what is YOUR background? How did you and your brother Igor get involved in the Bitcoin world to start with?

Vadim : Sure. That’s a long story, so I’ll try to make it quick – or as quick as I can. We’re both entrepreneurs. One of my last startups was in the online advertising space, where we created an exchange for large publishers to auction off their ads. So a large web site that couldn’t sell other ads would work with us, and we would have buyers – advertisers - bid in real-time for each ad. And those that couldn’t, we would predict the bid, and towards the end [we] spent three years doing that. The company got acquired. We were trading nearly a billion ads a day.

John : That’s a lot of volume, wow!

Vadim : Lot’s of volume. Then I left and started a hedge fund – a quant hedge fund called “Admire Capital”. We primarily focus on US equities, employing a number of quant strategies. But in August of 2013 we took notice of Bitcoin, and started exploring it; started trading on a number of exchanges, developing our own strategy. So that’s how I personally got into the space.

John : Okay.

[6:07] Vadim : We were very successful in doing that; almost raised a fund to focus on purely Bitcoin strategies. Around December of 2013 [we] decided not to do it, but I personally fell in love with the technology, [and] with the industry, and just really became passionate about what the opportunities of the future might hold, and just decided [that] this is what I wanted to do next. We spent about six months searching for the right opportunity. We were very close to starting a startup on our own, and then ran into Joe and [his] team at a conference in April. [We] started talking to him about leveraging Alpha Point’s tech for what we were working on, and through numerous conversations just decided to partner up. So it was a perfect fit.

John : Okay. Interesting. Now, from what I’ve read, you guys have a background in having owned a hedge fund. Is that right?

[7:03] Vadim : That’s right. That’s part of the background, and the hedge fund is still operational. It just focuses purely on US equities.

John : There’s been a lot of information in the press, obviously - in particular since 2008 – about hedge funds, and problems with hedge funds, and the dangers of investing in hedge funds. So how could you help to quell the fears of my listeners when it comes to talking about some of the inherent dangers found in hedge funds? And, of course, I know that you guys are the ones creating the software, but we also know that software can be written well, or it can be written poorly. It can be written to game the system, or it can be written to run legitimate businesses in a legitimate way.

Vadim : Sure. [I’m] happy to. The way we see it, on our end, is [that] we’re purely a software company, where we enable OTHERS to operate exchanges. So we’ve built a very, very fast matching engine. We can process nearly a million trades per second. And we can help launch new exchanges in, typically, under 20 days. So what we’re trying to focus on is helping exchange operators launch quickly in lots of places all over the world, so they can enable people to have easy access to digital currency.

[8:22] John : Okay.

Vadim : So that’s, kind of, our vision, right? So we don’t trade OURSELVES. We just provide software to operators that have their clients be the traders.

John : Okay. I see. Now what is your feeling right now, in 2015, about exchanges in the United States, versus exchanges is other countries, in terms of regulation? What’s your overall feeling about it? How are regulations going here in the United States when it comes to Bitcoin exchanges?

Vadim : I feel like it’s going slow. I feel that regulation is important when you look at it from the standpoint of consumer protection. But I personally wish that the process of creating solid groundwork for the regulation would move quicker - especially in the US. Not only is the process, but the fact that exchanges have to register in every single state, takes a long time. And it is somewhat forcing people to focus on other areas. If you take note, outside of the recent launch of Coinbase (https://exchange.coinbase.com/ ) – which I think is great, in opening an exchange in the US – all of the large exchanges are in other regions. And the reason why that is is because it’s so expensive, and so time-consuming, to be properly regulated in the US.

[9:45] John :Right. This is something we’ve been talking about. We’ve been saying to the regulators, “Look, if you regulate to hard here in the US, you’re going to push some of that tech to other countries, right? You’re going to push some of those opportunities to other countries. The opportunities are going to go – the money is going to flow – to the countries where the regulations are not so stringent.” Is that right?

Vadim : Yeah, and I think we already see that happening, right. Case in point, Bitstamp (https://www.bitstamp.net/ ) and BitFinex, some of the exchanges in China, right? They’re not in the United States. They’re also not in places like the UK, which is another huge market, typically for foreign exchange transactions.

John : Right. Now how is Coinbase having such an easy time about it? And by the way, I wanted to go to Coinbase – I have a Coinbase account – and I wanted to see their trading platform, and just check it out, but I can’t. They don’t offer it in Tennessee. The Coinbase exchange is currently not available in every US state. Do you see it eventually being available in every US state?

[10:38] Vadim : Yeah. I do. I think the main issue - in my opinion - that they’re having, is just getting approval for those licenses. That’s because some of the states are taking time to develop regulation specifically focused on digital currency. That’s happening with the BitLicense in the US. I heard that New Jersey just had hearings on that topic, I believe last week –maybe it was two weeks ago – but very recently. And going back to New York, as they’re going through and developing the BitLicense, they’re not offering any licenses for digital currencies. So unless you already have a money transmission license, and are already regulated by the state, if you’re a new entrant, or a new Bitcoin company, you can’t offer service. Eventually, I definitely think it will happen, just because of how much effort [is] spent by those states to go through the commenting period, but we’ll see when that actually will be.

[11:36] John : I see. Now the states in the US where it’s NOT legal, currently, to have an exchange, what do you think is holding them back? Is it political? Is it by region? What’s going on? What’s your feel for that?

Vadim : It’s really hard for me to comment. I’m not a regulator, so I can only speculate. My best guess is that they’re just trying to be careful, and create – what they consider is – good legislation. I also feel the other thing that’s happening is [that] what Bitcoin is is hard to define. Is it a commodity? Is it a security? Is it a currency? Is it some new hybrid, so we need a new term for it? And because of that there’s a lot of agencies that feel that they might need to play a role in regulating. So because of that, it’s taking extra time. The agencies, within THEMSELVES – are trying to figure out who actually needs to regulate what. And that adds to the delays that we’re seeing.

[12:32] John : Yeah, that’s understandable, and we’ve heard a lot of the conversations revolve around this idea – the idea that Bitcoin is going to be regulated as per its use, right? So if it’s being used as a currency then it should be regulated as a currency. If it’s being used as a commodity – traded as a commodity – it should be regulated differently than it is regulated as a currency. So I think THAT, kind of, confounds the whole thing in a lot of people’s minds. And maybe THAT is what’s slowing it down. They’re afraid to get it wrong when it comes to trading, versus using the IRS’s crappy definition of Bitcoin as real property, right? Of course, I would like to see the IRS and the regulators say, “Hey, do whatever you want with Bitcoin. Have at it. Have fun. Figure it out.”

Vadim : Or at least for some period of time. Right? Give it time to breathe. Give it time to develop. Give entrepreneurs time just to figure out what to do with it, instead of adding this huge level of burden and requirements that’s necessary to comply with before even getting off the ground. I feel like that’s the biggest danger. Somewhere in the early 1900s, with the auto industry, [regulation] was very prevalent in the UK. Then there were some laws passed – lobbied by the horse and buggy industry – that basically, under the premise that care are dangerous; they drive fast, and the hit and can kill pedestrians. So to solve that there was a law passed that said you need a flag-runner to run a couple of feet in front of the car, and alert people that a care is coming. Well, it kind of defeated the purpose of the car, right? That it can get you from “A to B” faster. And because of that Ford was started in the US. Innovation just shifted elsewhere. So that’s, I think, the biggest fear, or concern, for over-regulating something too early, where you don’t give it enough time to mature and develop and see what the potential is. Then all of the mindshare and the brilliant ideas are just going to go to countries that embrace that.

[14:36] John : Yeah, I think those “red flag” laws in Great Britain – at the turn of the century, with the coming of automobiles – I think that definitely hindered the automobile industry in Great Britain, and maybe gave Ford and the US an upper hand in that. I’m not sure to what extent that did, but I know that you’re right, it did. I also think that regulators here [are] looking at this thing, Bitcoin, as if it is a monster – a Frankenstein. Dr. Frankenstein is saying, “Look, I made this monster. I brought this thing from the dead, and I want to release it into the world. Just let it go out into the world, and let’s just see what happens.” And the regulators are saying, “Well, we don’t know what’s going to happen. We’re scared to death. We’re afraid that it might go out and kill the banks [laughter], kill all of these other industry that have a monopoly – or a stronghold anyway – on what people are allowed to do, such as remittances with Western Union, and all of that.” So, I think the regulators are really SCARED in a lot of ways, whereas we on the Bitcoin side, we’re the Dr. Frankenstein saying, “Come on. Just let it loose to see what it will do!”

[15:34] But the regulators – I mean, I can really understand their position. I don’t AGREE with their position a lot of times, but knowing the kind of people who are involved in regulating, and how often times [are] captured anyway, right? If you’ve read anything by Patrick Byrne, from his web site “Deep Capture” ( http://www.deepcapture.com ) a lot of these regulars [are] captured – in other words they’re beholden to somebody else. They’re not actually true regulators, looking out for the good of the people. Unfortunately, they’re not. I wish that they are, right? Vadim : I feel that that kind of view from the regulators is improving. I feel like I would definitely more tend to agree that this was the view in 2013, and at that point one of the biggest fears for the industry is that Bitcoin is going to be made illegal.

[16:22] John : Right.

Vadim : And right now I don’t think many people – outside of maybe certain countries – would make the same statement. Now it’s about – hopefully it’s not overly regulated, or regulations are not too burdensome – but I don’t think many people, any longer, feel that it is going to be made illegal. So that, in itself, is progress – positive progress. I think we all wish that the progress would happen faster, but it’s still going down towards a positive path – towards a good direction.

John : Yeah, I think so too, and I think that regulators here in the US, and elsewhere, realize the bigger picture. While they know that they can influence these other countries; they know that they can influence Syria; they know that if they need to they can kill a Ghadafi; they could kill a Sadam Hussein – if that person steps out of line. It’s not the same thing with Bitcoin, right? They cannot control every little country, and they certainly cannot control the continent of Africa – i.e. the U.S. government, the British government, the Israeli government. We cannot control what happens on the continent of Africa, right? So I think that they just realized, “Hey! We cannot control this thing. It’s out of our hands. So let’s try to regulate what we can within our jurisdiction.”

[17:37] Vadim : I think [that] people are starting to see, more and more, the benefits, and the potential, and the good the technology can bring, and not just focus around the negatives. On our end, our vision is that every single person, anywhere in the world, has easy access to Bitcoin – to either buy or sell Bitcoin. That’s what we’re trying to enable by powering exchanges, and letting local operators power those kind of on-ramps and off-ramps. And once you have access to Bitcoin, now the potential is limitless. You mentioned remittance, and a lot of people are working on that. There’s people working on all sorts of cool apps, and trying to disrupt all kinds of different pieces in the financial system. I think that’s awesome. That’s going to be really powerful, and it’s great to see more and more people start to realize and understand that.

[18:34] I agree. Now what do you think are some of the biggest challenges for Bitcoin to become mainstream, and how do you feel your company Alpha Point can help overcome some of those challenges?

Vadim : I think that access is very important. Letting people easily access a digital currency right now is still relatively difficult. Coinbase has done a decent job of that – or I should say a good job in the US. But there’s lots of countries all over the world. So what we’re doing is helping enable the exchanges in a local region to make it easy to do in whatever local jurisdiction they’re operating in. Beyond that, as far as challenges, I think useful application I would name as probably the biggest. The companies that we tend to see in the space, growing, operating, and successful right now are all mostly infrastructure businesses. The way I see the world of Bitcoin is, kind of, four pieces. You have the miners that create Bitcoin and verify transactions. Then you have the exchanges that provide on-ramps and off-ramps to the ecosystem. The next segment are the wallets, so once you buy Bitcoin you can be able to store it and spend it. The finally, after that, you have the applications. [19:54] The first application that I feel has gotten very good traction success is merchant processing, because the value to the merchant is really, really simple and really, really clear. If you accept Bitcoin you don’t have to pay for the high credit card fess that you’re used to. Especially in E-commerce, it’s a very low margin business, so that extra profit goes to the bottom line, and it’s very significant. So that’s the reason so many merchants – I believe it’s up to 80,000, maybe 90,000 – are accepting digital currency. I think that’s great, but it’s not a reason to buy and use Bitcoin. It’s a good reason for people to accept it, which is important, but it’s those use cases that you or your grandmother – and anybody in the world actually – I still feel like we’re missing. I think there’s a lot of smart entrepreneurs working on it, that we will see more and more of those, but that’s probably the biggest challenge.

[20:56] John : I think so. You know, as Andreas Antonopoulos often talks about – and a lot of other people talk about it too – here in the United States we really don’t NEED Bitcoin right now. I mean, I can go downtown, and I can get a cup of coffee, or I can get a sandwich. I can go down the street and do this or that. I can do pretty much everything I need to do – fill up my car with gas – without using Bitcoin at all. In other words, I can do all of this with facility, because I have a debit card. So, obviously it’s not going to catch on here in the same way that it’s going to catch on in Kenya, for instance, where they already have M-pesa (http://www.safaricom.co.ke/personal/m-pesa ) in place, using their “dumb-phones”. But what I wonder is what about the lower income people in the United States who are under-banked; who do not have a bank account; who do not have a debit, or a credit, card. I wonder if there’s a way that Bitcoin might help give THEM access to banking; to give THEM greater access to transferring value between people. It seems to me that that would be important for more of the poor people in the United States, and yet it doesn’t seem like anybody’s really talking about that. But let me ask you a question : Where do you see Bitcoin heading as a currency over the next, let’s say, 10 years?

[22:08] Vadim : So, I agree with what you said around what Andreas talks about – that there’s more use cases internationally than in the US, because we have such easy access. So I feel like the adoption will be faster in the countries where there’s more people under-banked; where you see the volatility of the local currency – due to inflation – be extremely high, where people don’t have faith in the local currency. So I feel like that’s where it has the potential to add the most value, and the greatest benefit. Maybe a person somewhere in Africa that has absolutely no access to digital music – because you need a credit card, and that needs to be tied to a bank account, so they just can’t purchase it, right? There’s absolutely no way. And all of a sudden they have Bitcoin, and now going through merchants that accept Bitcoin, they can have access to something like that. [23:04] John : Yeah.

Vadim : So that’s a use case. I think it’s totally possible that you might see – and I don’t know if this is two years, or five years, or twenty years – but at some point in the future, for a country that doesn’t have a strong local currency, to switch to a digital currency. And say, “Hey, this is interesting.” Now, it might now be Bitcoin. They may create their own local version of Bitcoin, and maybe have their own kind of a monetary policy around how it’s created and such.

John : Like we see in Ecuador.

Vadim : I’m not familiar with that one. The other thing that could happen is that people, or residents, in a country where there is crazy hyperinflation – especially during a time of high-volatility, where you see certain currencies just collapsing - all of a sudden you see a lot of people shift to Bitcoin, because they fell that’s stable. And that, kind of, spurs its own ecosystem where people shift to it; now they own it; now they start accepting it. I don’t remember where this has happened, so I won’t name a country, just under the chance of being wrong. But I feel that there’s been the case where there’s been a country [where] the currency collapses, [and] the banking and financial system is frozen.

[24:26] John : Mmm…Hmm.

Vadim : Where the local businesses created, kind of, IOUs within themselves, just so commerce can happen. And it almost created basically their own unit of currency while the banking system was frozen.

John : Cypress is a good example, and Greece is in a lot of trouble. Portugal, Spain [and] Ireland – they’re close to falling off these fiscal cliffs, as we see Europe spiraling down in this free fall, which does not look good from any direction really. But no, I think your point is well taken, that if a country has a currency that’s not doing well, or that’s falling apart if they have hyperinflation, that Bitcoin can do well there. Bitcoin can do really well in Argentina. The sad thing about Cypress is that you had a guy come in there and basically bring Bitcoin to Cypress, but then he basically conned everybody, and everybody lost all of this money. And so if you go onto the streets of Cypress, and you ask anybody about Bitcoin, they’re going to say, “Scam!” And it’s a a small enough country – it’s an ISLAND [laughter] – so anybody there now thinks that Bitcoin is a scam. [25:31] And because of that, a lot of other countries in the Mediterranean – Greece, for instance, if you bring it up to Greece right now, “Hey! This would be a perfect opportunity for you all to use Bitcoin– or something like Bitcoin – as your currency ”. But they’re looking at Cypress, their neighbor, and they’re thinking, “We’re not going to get suckered into this Bitcoin thing. We see what happened in Cypress.” So that’s kind of sad. I think that he was sent by somebody, basically as a setup, to make it LOOK like Bitcoin is bad, and to sully the name of Bitcoin for that region. Whether he was or not, it certainly had that effect, and that “fear factor” now is in that region when it comes to Bitcoin, although not as much as the fear factor is there when it comes to their own currency, and how difficult things are for people right now in Greece, in particular. The whole world is looking at Greece right now, and it really is a fascinating time. So let me ask you a question. What advice would you give entrepreneurs who are getting involved in the Bitcoin field right now? Because you guys have been entrepreneurs – you and your brother – and you’re succeeded. And you’re succeeding with Alpha Point. But for new folks starting in, that are looking at you guys – and looking UP to you guys. What advice can you give these young guys?

[26:42] Vadim : Sure. I think the main thing I want to say is it’s still really, really early. What that means is that there’s still tons of opportunity for people to build really amazing things that end up [being] really amazing businesses. So that’s the kind of first point. Then the second one is just focus on where the big holes are in bringing value to somebody. Like I mentioned before, I feel like a lot of the current, successful companies are infrastructure plays. It’s essential, and it’s necessary, but that leaves a lot of room for people to build great applications. That’s where I feel the true opportunity is. A lot of analogies are made to the internet, right.

[27:28] John : Mmm…Hmm.

Vadim : Right? And the internet started just on protocols. Protocols are very techy – hard, if not impossible - for the common person to understand. Then someone made email simple – and just the whole concept of email is really simple. You can call up your grandmother and say, “Hey, you know those letters you’ve been writing me? And you put a stamp on it, and it takes a week or maybe longer to get them to me? Then it takes another week for me to respond? Why don’t you type it into the computer, I’ll get it in a minute, and then respond to you by the end of the day?” It’s just such a strong, clear value proposition, and I feel like Bitcoin is starving for those types of applications. So that’s what I think new entrepreneurs entering the space should be focusing on.

John : I like that. Just try to imagine what could be stacked on top of Bitcoin, right?

[28:16] Vadim : We’re very much a part of that infrastructure that I’m talking about, that’s an essential layer for everything else to operate. If you can’t buy and sell Bitcoins, you can’t build applications, because it would not be possible to get a Bitcoin to use your application. So what we do is enable the exchanges to provide that service, which is an infrastructure business. And I think that, on top of that, people should build applications that are useful. John : Okay. So how is Alpha Point different from its competitors? Obviously, you guys have competitors out there who are doing the same thing. Vadim : First, I don’t know any other competitor – and I could be wrong – that has any strong traction in this space. I mentioned we have 18 customers - including one of the largest exchanges- using our platform. I think we have a strong differentiation in the founders [who] come from the industry, and know how to build institutional-based systems that Wall Street can connect to and use. And if anything, when you talk to customers, their decision typically is either leverage our platform, or build it in-house. [29:33] John : Mmm…Hmm.

Vadim : And building exchange software is really hard. It can take a long time – sometimes a year or more. And even once you’ve built it, when you’re scaling something it’s very, very difficult. You might be able to build a good enough system that supports a couple thousand users, but if your exchange becomes very, very successful, it might buckle under the strain of all the volume that’s being sent to it. So that’s where we come in. We help people launch exchanges quickly – under 20 days – and let them focus their resources on building a great business, and not on the technology.

John : And then down the road help them scale that up, right?

Vadim : Yeah, that’s right. The other important thing that I forgot to mention earlier [is that] the second piece that we provide is liquidity - which is really, really important. When the exchange launches, and they get their first buyer, if they don’t have a seller, they don’t have a business.

[30:34] John : Mmm…Hmm.

Vadim : What we do is we interconnect all the exchanges on our platform. So when an exchange launches in a country – let’s say, Mexico - as a buyer, they can connect to a seller in another exchange that might be in Canada, or Norway, or anywhere in the world. So, that’s the second piece that we solve for the exchanges, and it’s really, really important.

John : I see. That’s pretty substantial. That’s acting as the middleman there, or the bridge between these different exchanges – through the software, I mean, right?

Vadim : Yes, through the interconnectivity. Just purely through the software piece.

John : Do you all have an end goal that you’re heading towards with Alpha Point?

Vadim : Our vision is to allow anybody in the world easy access to digital currency. I think this will be an essential part of the growth of the industry.

[31:21] John : Wow. I think that’s a good goal. I think that’s something that’s definitely needed right now. And I think that the exchanges, as they continue to grow, in numbers, I can only imagine that your company is going to continue to grow as well as your software grows with it, right? Because as you build –- as you have BUILT the software over time – things change. It’s not this static thing. It’s, kind of, a living thing that can change as regulations change, or as new developments come up from country to country that need to be addressed. I guess that’s what software does, and needs to be able to do, right?

Vadim : Yeah, absolutely. I mean, we’re very hard at work building new features. A lot of that is driven by our customers, and the feedback we get. And we’re just very, very excited about the future.

John : Man, that’s cool. Now let me ask you another question here. What do you guys think about the Winklevoss twins [laughter], and what those guys are trying to do?

[32:14] Vadim : I know they obviously own a lot of Bitcoin. They were “early believers”, which I think was awesome. And …

John : I’ll ask the question again, “Okay, what about those Winklevoss twins? What the hell are those guys up to?” [laughter]

Vadim : They’re trying to get a regulated EFT in the market, which if they’re successful my belief [is it] will drive a lot of volume, and a lot of interest into the space, So I think that piece is really, really positive. It’s unfortunate that it’s taking so long, but I think if they’re successful at doing that, it will be positive for the industry.

John : Yeah, I think so. It seems to be taking an awful long time, isn’t it? I wonder what’s going on with that. I’m confused whenever I read something about it. It’s like, “It’s coming soon.” Well hey, listen Vadim, it has been great talking with you today, and it sounds to me like Alpha Point is off to a wonderful start. How old is the company now?

[33:02] Vadim : We’re about a year-and-a-half old.

John : About a year-and-a-half old. And, of course, in the Bitcoin world, that doesn’t make you guys babies. You guys are really right there - I mean, a year-and-a-half in the Bitcoin world is like 10 years in any tech field.

Vadim : Yeah, it’s a long time, and we’re very happy that we got into it early.

John : I’ll tell you what, man. I’d love to have you back on the show at some point, to give us and update on Alpha Point and how well it’s going. It sounds like you guys are doing great. Listeners, you have been listening to Vadim Telyatnikov, the CEO of Alpha Point. Alpha Point is software that is allowing Bitcoin and other digital currency exchanges, worldwide, to flourish. Vadim, thank you so much for being on the show.

Vadim : Thank you. I really enjoyed it.

John : Oh hey, before you go, can you tell our listeners the best way that they can get in touch with you.

Vadim : Sure. It’s really easy. They can just email : sales@alphapoint.com , or myself vadim@alphapoint.com and we’ll be happy to talk to them.

John : Okay great Vadim. Hey, thank you so much, and stay warm there in New York. I’ll do the same here in Nashville, and we’ll somehow make it through winter and into the spring. Spring is just around the corner.

[34:09] Vadim : It is.

John : All right man .Hey take care.

Vadim : You too.

John : All right .Bye.

Vadim : Thanks. Bye.

[Segway music]

Today’s “magic word” is “Shysters”, S – H – Y –S –T –E –R –S, as in the sentence, “Why in the hell are there so many shysters in the Bitcoin community?”

[background music begins]

John : Well I am in a thoroughly rotten mood right now. And I guess what got me in this foul mood was one of my listeners, who goes by the name of “enemyofthestate”. This guy recently commented to Episode 56, in the show notes, on the Let’s Talk Bitcoin page. He starts out in a rational way, and here’s what he said…

[35:06] [(“enemyofthestate”)] “John. I love your show. I can also assure you that I’m not hopped up on testosterone or estrogen. If you could define fair/slave wage that would be great. Thanks.

John : So I did respond, and I wrote, “Certainly. Slave wages are what corporations currently pay to migrant workers who pick fruit in many parts of the U.S. Many of these people are housed in poorly insulated, and poorly furnished trailers. And they are often packed in. Sometimes their contracts and visas allow their employers to pay them far below that state’s minimum wage. They have options of buying food at specific stores at prices higher than what locals pay for the same products. Slavery is real on planet earth. Children all over the world are still abused and forced to work for - get this - just enough food to keep them working. Getting paid in only food is also a slave wage. [36:01] I pay Franky a low Bitcoin amount for transcribing my show each week. But I also advertise his service on my show, so we feel a balance is there, and thus a win-win. This is a fair wage, even though it's a low dollar amount. How does one put a price on an ongoing podcast that has already reached over 1/4 million listeners worldwide? Moreover, each episode will live on "in perpetuity" – if you will - on Youtube, Soundcloud, the Let's Talk Bitcoin Network and, of course, my web site : http://www.bitcoinsandgravy.com “.

John : I go on to further define slave wage…

“A slave wage is what big city pimp pays his prostitutes. Usually they earn food, and possibly drugs, and [some clothing occasionally]….[indecipherable]… Some people would consider minimum wage to be a slave wage. Working in the hot sun in Dallas as a roofer, and getting paid $7.50/hour might look like a slave wage if they guy working has a stay-at-home wife and 3 kids. But, on the other hand, maybe if one of his co-workers is single, and lives in a small, inexpensive apartment - maybe with roommates or with his girlfriend who waits tables and brings in an equal amount. Then that $7.50/hour can actually go a long way. [37:12] Frugality is a factor. Whether or not they decide to have children is ALSO a factor. No one forces people to have children, but for some reason the poorest people seem to have a lot of children. Why? The reasons are many, and I have always found it hard to blame those who are born with a deficit in education, money, diet or love. Life is hard for all of us, but it’s a hell of a lot harder for many of these people considering how they start out. Take many of us and put us in a housing project in the inner city as an infant, and see how well we fare, and how far we get in life. Many would do well. But, in fact, most would not rise up much beyond what they see around them. Psychologists and sociologists know this to be a fact.” End of quote. John : And then at the end, I use a little humor to define “fair wage” for “enemyofthestate”, and I write : “Fair wage? … [music] …What I make as the host of Bitcoins and Gravy - about $50 a week - minus expenses - and the joy of interviewing interesting people from all over the world.’ “Enemyofthestate” responds :

[38:23] [“enemyofthestate”] : John, you’re a gentleman, but you have absolutely no idea what the fuck you’re talking about when it comes to economics. Thanks for taking the time to respond to my comments.”

John : [laughter] Then right after that one of my favorite listeners, “dgiors”, responds with :

[“dgiors”] “I don't agree with everything @johnbarrett says but at least be civil when you disagree. It also helps to pick apart the argument and supply counter-arguments. Simply telling somebody they know nothing isn't constructive at all. So please elaborate [as to] why you disagree and there can be a useful discussion here.”

John : Oh, wow. I agree. Hey, thank you once again “dgiors”, and I could not agree with you more. “Enemyofthestate” did NOT have the balls to come back with a counterargument, or statement of any kind. And since he seems to have a solid knowledge of economics – [fake coughing] whatever the hell THAT might mean – it would have been nice if he could have had the balls the share some of his vast knowledge with the rest of us.

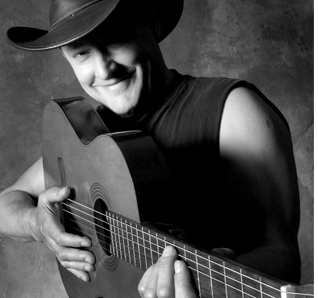

[39:19] Hey folks, I am definitely not and economist. I’m not a programmer, or a coder, or a software designer, or any of that. I’m just your average Bitcoin enthusiast [cough] “who loves talking about Bitcoin , and sharing what I learn with YOU, the listener.” Seriously, I started out this podcast because I love Bitcoin, and it’s potential to bring positive change to the world. And if any of you have ever taken a close listen to my song “Ode To Satoshi” (http://bitcoinsandgravy.com/ode-to-satoshi-the-official-bitcoin-song ), you’ll understand that it’s not a tongue-in-cheek song aimed at making people laugh, nor was it written for children as a nursery rhyme. What do you think I mean when I wrote : “From the ghettoes of Calcutta to the halls of Parliament?” Well, I’ll tell you. That line is about imperialism, and a direct reference to the immoral British occupation of India, that was by the way, eventually dismantled, beginning with the peaceful opposition movement of a great man that we refer to as Gandhi.

[music]

[40:18] John : “Enemyofthestate”, if you are listening, please understand that I am what I am, and it’s not easy at times to interview so many intelligent people in the tech world, and in the world of big business, finance and economics. I DO agree with Nicholas Necine Talib in his assessment of economists, when he pokes fun of them. I think, more than anything, what he is really saying is that he has seen so many people in academia striving to get tenure; striving to get funding, and get published, that he finds it hard to take them seriously any more. When one economist makes a prediction about the future, and then the opposite happens, what are we laymen to think? When an economist rises up to the level of a Paul Krugman, for example, and has the attention of media outlets worldwide, and then stands there and makes foolish statements, such as Krugman’s statement that, “Bitcoin is evil.” Then what are the non-economists in the world supposed to think, right?

[41:10] Moreoever, we hear learned men having heated debates about Keynesian versus Austrian economics, and yet when all is said and done people are still underpaid, over-worked, over-taxed, malnourished, depressed, and dying all over the world. [Yet] damn near every one of these economic geniuses has a nice house, quadruple air bags in his car to protect him from any driving mishap, a refrigerator packed with goodies, and 50,000 options for entertainment at their fingertips. From the average person’s perspective you economists aren’t getting much done. To “we the people” you are no more trustworthy - or relevant even - to our immediate lives than your average career politician.

So my final message to my listener, “enemyofthestate” is this : if YOU can’t define “slave wages”, and if YOU can’t have a man-to-man discussion with me in a civil manner, and if YOU can’t refrain from cursing me, and treating me like a piece of shit, than you fuck off you punk!

[42:04] I work two hard doing this podcast to take that kind of shit from you. I’ve got two jobs, a mortgage to pay, massive bills I pay alone, and no time for punks like you to ruin my day. I guess my skin is too thin, folks, but I put in about 10 hours each week to produce this podcast, and I make less than $50 per week doing it. So since you’re such an economics genius, you do the math, “enemyofthestate”. And tell me if it’s worth my putting up with shit from a dweeby little bitch like you.

[music]

John : [laughter] And my second rant of the day – the following is my angry response to an article I read this past Thursday on The Bitcoin Magazine site (https://bitcoinmagazine.com/ ) - which, by the way, is one of my very favorite sites for information about Bitcoin. The article was written by Christie Harkin, and was published on February 15th, 2015. It’s a short, but well-written, article [titled], “After Chaotic First Day, Bitcoin Foundation Reboots Run-off Election” :

https://bitcoinmagazine.com/19401/developing-story-bitcoin-foundation-elections-shambles-candidates-call-restart/

[43:03] As I mentioned, I generally try to refrain from using profanity, but in this instance I have to say, when it comes to the Bitcoin foundation election debacle, I have to say this…

You’ve got to be fucking kidding me! Are you telling me that with all of the amazing tech talent in the Bitcoin community - and supposedly in the Bitcoin Foundation - that a basic election – a tallying of votes, a counting of choices – could not be successfully carried out? This is NOT gross incompetence, and I refuse to believe that. I am going to agree with candidate Olivier Janssens, and applaud his accusation [applause] that Patrick Murke – the director of the Bitcoin Foundation, did in fact, commit – and I quote Janssens - “A serious breech, and a clear attempt, at throwing a wrench in the machine.” And, “Totally, and purposely, manipulating the voting process.”

I mean seriously folks, what hell is going on? This is like Diebold voting machines fixing a federal election, which led to me having to see the snarling little man-child face of “W. Bush” for eight fucking years, and the death of countless human beings all over the planet. Right? An election gone bad.

[44:11] And we all site back and let this shit happen over and over again. So now what? When it comes to the Bitcoin Foundation we’re supposed to accept the fact that we have this half-man, half-“Wally Cleaver” slick-talking bullshit artist attorney as the head of the Bitcoin Foundation? What a fucking joke. Now that chubby little chump is trying to pretend like this major fuck-up has something to do with anti-fragility – “It’s going to be good for us in the long-run, and help us refine the system.”

Bullshit! How the hell did we get here, is what I want to know? A fucking attorney at the head of the Bitcoin Foundation? You know, honest to God, half of the shyster politicians in D.C., and around the globe, started out in law school, and then ended up making laws, telling people what to do, and generally being “yes men” for one evil empire or another. Is there a force of evil in the world that these doughy little men are somehow tapping into? The last thing we need at the helm of the Bitcoin Foundation ship is a fascist with a “God complex”, and no moral compass whatsoever.

[45:08] Hey Murke, you may have gone the way of Darth Vader, but I’m telling you, one of these days some Luke Skywalker is going to come around and shove his lightsaber straight up your attorney’s bum, if you don’t get out of the way of progress.

You know, honestly, I’m starting to think that Cody Wilson might just be right. Murke, your time is going to come. It won’t happen today, it won’t happen tomorrow, and it won’t happen when you least expect it. But one day, when you’re old and shriveled, and dying in a wheelchair in a retirement home somewhere out west, where the air is dry – “Whew….” And tumbleweeds tumble across the plains – [“Old West” vocally produced sound] -- someone will come up behind you and slip a hit of LSD into your meds. Then that someone will wheel you over to the massive wall-screen [wheel screeching vocally produced sound], and turn the station to the Jerry Falwell Three Show.

[46:05] The images and sounds will rush to the core of what’s left of your brain, and you’ll be subjected to the wrath of the mighty God almighty. Your ears will begin to burn, as if hot ice picks were thrusting in. Your piss-bag will bubble up and overflow, with the feeling of scalding lava running down your scrotumulous sack, and on down between your legs. Your teeth will chatter out of your mouth and onto the floor, where you will see them do a little Can-Can dance, away from you [teeth chatter vocally produced sound]. You’re bird-like hands [bird screeching vocally produced sound] will grip the arms of the wheelchair in terror, and lock on with a death grip as your mind explodes in a kaleidoscopic horror show of multi-colored MADNESS. Your eyes will melt out of their sockets, and hang from your brittle skull, as if on cartoon springs [vocally produced sound of spring unloading]. And your heart….

Oh, never mind. There is no heart in that carcass, and there never was. [laughter] Let me get a sip of tea here.

[47:08] And my final rant of the day – Whew! – is in response to a Tweet by Brian Armstrong, the CEO and cofounder of Coinbase ( http://www.coinbase.com ), everyone’s favorite white-collar, silk tie, Bitcoin wallet, and now exchange. Brian Tweeted :

[Brian Armstrong (Tweet}] “Ripple, Stellar, and Alt-coins are all a distraction. Bitcoin is way too far ahead. We should be focused on Bitcoin and sidechains”

John : [laughter] I do have a lot of other voices besides just that one voice. I think that was the same voice I used for “enemyofthestate”. You know, just the voice of a [beep sound] . Anyway, first of all Brian, your statement of, “We should be focused” is ridiculous. Here at the dawn of the Age of Crypto-currencies, “we” are millions of people, involved in tens of thousands of different projects, with tens of thousands of different focuses. I sincerely hope that you would not actually want to pull everyone everywhere off their projects, to acccommodate what you have put your heart and soul into, and what YOU feel is important. This seems not only impractical, but impossible as well. It also seems a bit selfish and immature if you ask me. [48:15] Now, please allow me to address your false assertions. Brye, Brye… I’ll explain it to you this way, “Ripple is a ship, and Bitcoin is a train.” There is no “way too far ahead”, because you see, son, these two very different protocols are working in different dimensions, on different planes. They have different end goals, use cases, and users, etc. etc. With all due respect, Mr. Brian Armstrong, your comparison is sophomoric at best. And what about alt-coins? Young man, moving forward and past some static fantasy that lays comatose in the back alleys of your “mind ghetto”, there will be MANY alt-coins in the future – unless, of course, the planet loses power, and we find ourselves back to stone age living. Now personally, I’ve watched almost all the old Flintstones episodes, so I imagine that I would actually fare pretty well in a stone age environment. And believe it or not, I’d be perfectly fine watching television by candlelight if I had to. [49:12] But with alt-coins it’s not just about the unique utility, and functionality, and innovation that we see all around us every day. It’s also about thousands of kids sitting around in their yellowing underwear, smoking weed and running to the kitcheN every hour or so to nuke another Hotpocket, and get a glass of milk. These kids refer to themselves as traders. They love BarbecueCoin. The get erections entrepreneur masse when LiteCoin, or NameCoin moves up or down a fraction of a nickel. And some of these traders earn money all day long – buying and selling, selling and buying – usually just enough to buy another eight ounce of “the dank”. And guess what? They’re addicted to the game. Get it? They don’t EVER want to stop. They bring in new recruits all the time, from school or from the mall. And their numbers are growing steadily, because there IS money to be made doing this.

[50:02] Listen Brian. Fruit Of The Loom would go out of business if alt-coins ceased to exist. Lunchables. Eggos – as in “Leggo my Eggo”, Captain Crunch, Red Bull, and Slim Jims. all of these uniquely American innovations would also cease to exist if alt-coins somehow magically disappeared before every young trader’s eyes. Bry, bry, the world of crypto-currencies, Bitcoin, Ripple, Etherium, Stellar, Darkcoin, Litecoin, etc. None of this is about making sense. And it’s certainly not about common sense. It’s not about predictable variables that computer scientists can check against their atomic clocks. And it’s not about Keynesian or Austrian economics. It’s not about hierarchical structures, like centralized corporations dictating what we can and cannot do. And it’s certainly not about ones and zeros anymore. It’s all about fear and greed and passion, and love and lightness, and despair and humor, and tragedy and hope. And a belief that thing might somehow get better for humanity this time around, if we can just…

[music and lyrics to “Ode to Satoshi” song]

[51:06] John Barrett : Now climb aboard y’all! This train is bound for glory… and there’s plenty of room for all…

“Well Satoshi Nakamoto, that's a name I love to say, And we don't know much about him, but he came to save the day. When he wrote about the way things are, And the way things ought to be, He gave us all a protocol this world had never seen.

Oh Bitcoin! As you're going into the old Blockchain, Oh Bitcoin! I know you're going to reign, gonna’ reign, Till everybody knows, everybody knows, Till everybody knows your name.

[guitar instrumental]

Down the road it will be told about the Death of Old Mt. Gox, About traders trading alter coins, and miners mining blocks. But them good old boys back in Illinois, And on down through Tennessee, See they don't care to be a millionaire, They're just wanting to be free.

Oh Bitcoin! As you're going into the old Blockchain, Oh Bitcoin! I know you're going to reign, gonna’ reign, Till everybody knows, everybody knows, Till everybody knows your name.

[instrumental interlude]

From the ghettos of Calcutta, to the halls of Parliament, While the bankers count our money out for every government. Oh, Bitcoin flies on through the skies of virtuality, A promise to deliver us from age-old tyranny.

Oh Bitcoin! As you're going into the old blockchain, Oh Bitcoin! I know you're going to reign, gonna’ reign, Till everybody knows, everybody knows, Till everybody knows your name. Till everybody knows, everybody knows, Till everybody knows your -- "Give me some exposure" -- Everybody knows your name.

Singing, Oh Lord, pass me some more, Oh Lord, before I have to go. Oh Lord, pass me some more, Oh Lord . . . before I have to . . . Go . . .

[instrumental finale] [applause]

John : Oh-ho! Thank you East Nashville! Y’all be good to each other out there, ya’ hear?

[Segway music]

[54:14] I’d like to than my guest on today’s show, Vadim Telyatnikov, the CEO of Alpha Point. Alpha -Point is powerful software that allows you to launch an exchange in DAYS, not months. Exciting stuff folks. And you can find more information about today’s guest in the show notes at : https://letstalkbitcoin.com/blog/post/bitcoins-and-gravy-57-alpha-point-powerful-software-3 On Soundcloud : https://soundcloud.com/bitcoins-and-gravy/bitcoins-and-gravy-57-alpha-point-powerful-software And on my web site : http://www.bitcoinsandgravy.com And “Here Ye! Here Ye!” Coming soon you’ll be able to find full transcripts of each episode of Bitcoins and Gravy in the “transcripts” section of http://www.bitcoinsandgravy.com . Professional transcriptions [are being] provided by one of our fans who can be found at :

http://www.diaryofafreelancetranscriptionist.com

More on this in a few weeks, and thanks for your patience friends. It is coming soon.

Look for me at the Texas Bitcoin Conference in Austin, Texas next month, and let’s sit and have a beer together. Even if your name is “”enemyofthestate”, despite my ranting and profane commentary, I will still sit and have a beer with you sir, if you would like. Or, if you prefer, we could leg wrestle to see who has the greatest reserve of testosterone. [55:18] If you’ve enjoyed the show today, please take a minute to leave a comment on Let’s Talk Bitcoin, in the comments section, right there below the show notes : https://letstalkbitcoin.com/blog/post/bitcoins-and-gravy-57-alpha-point-powerful-software-3 You can also leave a message on Soundcloud : https://soundcloud.com/bitcoins-and-gravy/bitcoins-and-gravy-57-alpha-point-powerful-software Or do the old fashioned thing and send me an email. And, of course, Bitcoin and Litecoin tips are always appreciated by the hardworking writers and podcasters in the Bitcoin world. Many of us work as volunteers, and sure could use those tips. Signing off now from East Nashville, Tennessee. I’m your host John Barrett, with my trusty companion Maxwell by my side. Say goodbye Maxwell.

Maxwell : Grrrr…..

John : Y’all be good to each other out there now. And remember, the only thing necessary for the triumph of evil is for good men and women to do nothing.

[show outro music]

[voice mail message of fan caller]

[56:12] Check, check. Is this thing on? Hey, I’m doing a voice memo to you, John Barrett. My name is Christian Burns, and I wanted to give you some feedback about your show. I love it. I’ve loved it since the beginning, and - anyway, I’ve never sent you any messages. But last week I was listening, and all of a sudden you were making a comment – I hope you can hear me over the noise… I’m driving down the freeway, in Seattle, Washington. Actually, I’m halfway between Seattle and Canada at this point. So, you were talking on the show about the Texas Bitcoin Conference - which I loved you interviews from last year about the Texas Bitcoin Conference. I love those kinds of thing. Then all of a sudden it hit me, “I need to go to that thing.” Like, it’s far away from me, for me to get there. I don’t have money to go to stuff like that. It’s not part of what I do. [57:12] And all of a sudden it hit me, “I’ve got… Could I do this? What’s the number?” So it brought me down a road of looking it up, and I was like, “Okay…” Then I talked to my wife, and I said, “I’ve got this crazy idea.” And we’ve been excited about Bitcoin for over a year. And so - it’s been kind of depressing at points - but we’ve been really excited about it. Anyway, we still believe. [That’s all I’ve got to say about it.?] I just want to thank you for talking about the Texas Bitcoin Conference. I knew it was happening, and then I realized that I needed to go. [58:03] So, one, I’m going. I’ve got my tickets, my airfare. I’ve booked a place to stay. But I appreciate your show. And the other thing I really appreciate, John Barrett, is “Ode To Satoshi”. I tell you, I drive a lot for my job, and whenever I hear “Ode To Satoshi”, I sing it in the van, at the top of my lungs. And it helps me to dream about the future. Anyway, I want you to know that I will see you at the conference. I’ll find you. It’s not going to be that massive that I can’t find you. You’re going to be the guy with the guitar, playing “Ode To Satoshi” . [58:52] And then that is it. So I just finished your last episode, and anyway – I’m rambling now. But I just wanted to say thank you, and dream of a greater future, freedom for our kids – well, my kids – you dream of a future for my kids too, which is awesome. You want my kids to live in a better world too. So that’s cool we have that in common. Anyway, I’ll chat with you later. [end of voice mail message]

[59:35] Max : Grrrr…. Grrrr….